Actelion Pharmaceuticals – the R&D investment and its returns

It is true that accounting is inconsistent in dealing with capital expenditures and operating expenditures of manufacturing firms vs technology or R&D based firms. The operating expenditures are designed to generate benefits in the current year whereas capital expenditures are designed to generate benefits in the future. The US GAAP does not allow the R&D to be capitalized where as in IFRS, certain portion of development cost can be capitalized provided there is a certainty in future benefits.

Hence, we decided to take Actelion Pharmaceuticals (ATLN.VX)as an example to understand the impact on its return on capital when it capitalizes its R&D vs when it does not. The idea of this exercise is that as a risk averse investor, one would prefer investing in a company with better R&D productivity i.e. better return on capital on its R&D investment.

Actelion Pharmaceutical

Actelion Ltd. is a leading biopharmaceutical company focused on the discovery, development and commercialization of innovative drugs for diseases with unmet medical needs. Actelion is a leader in the field of pulmonary arterial hypertension (PAH). Their portfolio of PAH treatments covers the spectrum of disease, from WHO Functional Class (FC) II through to FC IV, with oral, inhaled and intravenous medications. Although not available in all countries, Actelion has treatments approved by health authorities for a number of specialist diseases including Type 1 Gaucher disease, Niemann-Pick type C disease, Digital Ulcers in patients suffering from systemic sclerosis, and mycosis fungoides type cutaneous T-cell lymphoma.

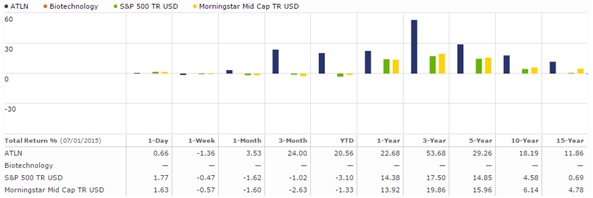

Actelion’s stock price movements

Actelion’s stock price jumped from 41 CHF in July 2010 to 138.5 today 1st of July 2015. Comparing with S&P500 and Morning start midcap companies, Actelion seems to be ahead in the game.

Source: Morning star

The R&D Investment and returns

Before we capitalize Actelion’s R&D investment, let us first understand the reasons why accounting does not permit capitalizing R&D:

- Benefits are uncertain: It is true that R&D is uncertain but so an investment in a manufacturing plant in countries torn with civil war. Even some of the giant companies such as HP have tried to build tablets which were unsuccessful in the market, but those expenses of manufacturing were capitalized. Accounting was developed way back when manufacturing was one of the key businesses. Since then, the business models have changed – we have businesses such as Uber, Airbnb, consumer product companies such as Coca Cola and Biotech companies that might not own big chunk of tangible assets but in order to generate long term returns, they do lot of investments on R&D, training and advertisements. Hence, those expenses ( or a portion of those expenses) that would generate returns in long term need to be capitalized

- Being Conservative: One of the arguments is that by expensing the R&D, the earnings are conservative. However, by expensing, we are depriving the biggest asset from the books of Biotech companies i.e. their R&D. That also implies that the return on capital for those companies spending huge amount on Intangible assets will look inflated.

Impact of R&D Investments on Return on Capital

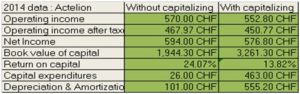

Actelion spent 437 M CHF in the R&D in 2014.

In order to capitalize, it is important to first define the amortizable life of R&D i.e. how much time it takes Actelion to launch the product from its R&D lab to the market. Given the strategy to develop its own products as well as in license at very late stages, an average of 5 years was assumed (contrary to typical product development time of 10 years). After collecting the five year R&D expenses from 2009 – 2013, the unamortized R&D over the period was sum up. The unamortized R&D is the value of the research asset and will be added separately during the calculation of book value of capital.

The Value of the research asset/unamortized value of the R&D = 1317 M CHF

Total amortization of R&D asset for 2014 = 454.2 M CHF

The R&D expenditure for 2014 i.e. 437 M CHF is not amortized assuming that it is invested just yesterday.

(All the earnings in CHF millions)

The return on capital without capitalizing (24%) looks very attractive in comparison to 14% after capitalizing. This is because the book value of capital of 1556 M CHF does not include the value of the Intangible asset i.e. R&D investment done in the past.

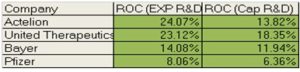

Competitive analysis

In order to understand how Actelion’s competition fare in terms of their R&D investments and returns, we decided to check the return on capital (ROC) of the competition: United Therapeutics (UTHR), Bayer (BAYN.DE) and Pfizer (PFE). If the ROC increases after capitalization, that’s a rough indicator that the investment on R&D generates greater return than the investment on traditional assets.

The following table gives the ROC (expensing as well as capitalizing) of the competition:

It seems that capitalizing R&D has the maximum impact on Actelion. Although the profitability ratio seems very high but capitalizing pulls down the actual ROC. Capitalizing R&D provides an answer to the question: Is R&D investment good for the company? Of course, it is, provided it helps you to make excess returns in the future. Actelion does make excess returns i.e. its return on capital is higher than the cost of capital, however, our view about how much excess returns it has actually made is different when we capitalize the R&D investments i.e. investments that are meant to generate returns in the multiple periods.

Consequences for Valuation

When we capitalize the R&D, we are changing several financial statements. We evaluate its impact on the following parameters important for Valuation:

- Operating Income: The operating income changes by adding back the R&D expense and subtracting the amortization of R&D.

- Free cash flow to the firm (FCFF): It remains the same as earnings and reinvestment change by the same amount

- Growth rate: The fundamental expected growth rate depends on how much the company reinvests (in the form of capital expenditures and change in non-cash working capital) and how well it reinvests which is measured by the return on capital. If the operating income as well as the reinvestment increases, the reinvestment rate would increase. If the ROC is greater after capitalizing R&D, it can be assumed that returns on R&D investment is greater than the returns on traditional investments. Hence, the growth rate will increase or decrease depending on whether reinvestment rate and the return on capital increases/decreases

Does Actelion’s Intrinsic value decrease or increase after capitalization? We will see its impact in detail in our next post on Actelion.

In sum, we see that the accounting treatment of CAPEX at manufacturing firm is different from that of technology based firms such as Biotech and pharmaceutical companies who invest huge sum of money on R&D to generate returns in the future. Expensing R&D provides a skewed view of the returns they are making on their investments and also has an impact on the value. The companies who manage R&D efficiently will have higher return on capital when capitalized.

Assumptions:

Return on Capital: The book value of capital used is based on 2013 while the after tax operating income is from 2014. The argument is that in the real world there is always a lag between the capital invested and the returns the company generate

Tax rate: Actelion received tax benefits in the year 2014. However we used the marginal tax rate of 17.9% (KPMG data) for Switzerland with the assumption that it cannot earn the benefit throughout its life. For others, effective tax rates are used

CAPEX: Includes PPE, cost of acquisition and R&D

R&D amortization period: For Actelion, a 5 year period is chosen as the company not only develops its own products at early stages but also licenses in at very late stage to launch the products. Hence, on an average, we used 5 year period for the amortization

All data collected from the Annual reports from respective companies

Disclaimer: Farmantra or its employee and author, Saurabh Mishra does not hold any shares in Actelion. Farmantra does not have any assignments -profit/not for profit with Actelion Pharmaceuticals.

Leave a Comments