Our Approach to Discounted Cash Flows Valuation

We don’t treat valuation as a one-size-fits-all model. Instead, we apply a flexible set of methodologies tailored to the development stage and available data of each asset.

Point Estimates

When an asset is in an advanced stage of development—with a market access study in place and strong insights into potential market penetration from key opinion leaders (KOLs)—we use a Discounted Cash Flow (DCF) model based on point estimates of future cash flows. However, this situation is not typical.

Early-Stage and Highly Uncertain Assets

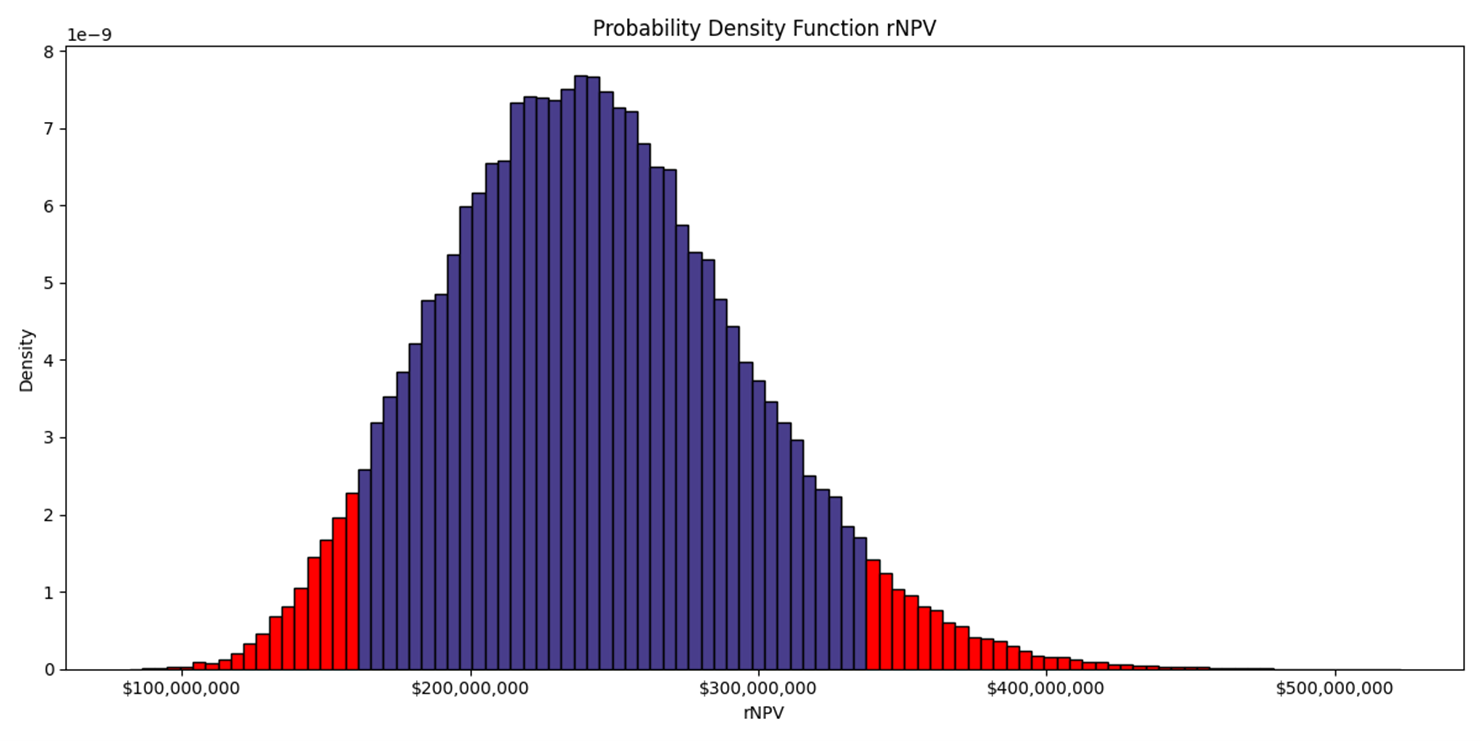

For assets in early development or with limited market data, we apply a probabilistic approach. Rather than relying on single-point estimates, we evaluate value based on the probability distributions of key variables. Using the maximum entropy principle, we select the most appropriate distributions and incorporate statistical moments such as mean, variance, and skewness. This allows us to reflect uncertainty more accurately in our valuation.

Valuing Flexibility with Decision Trees

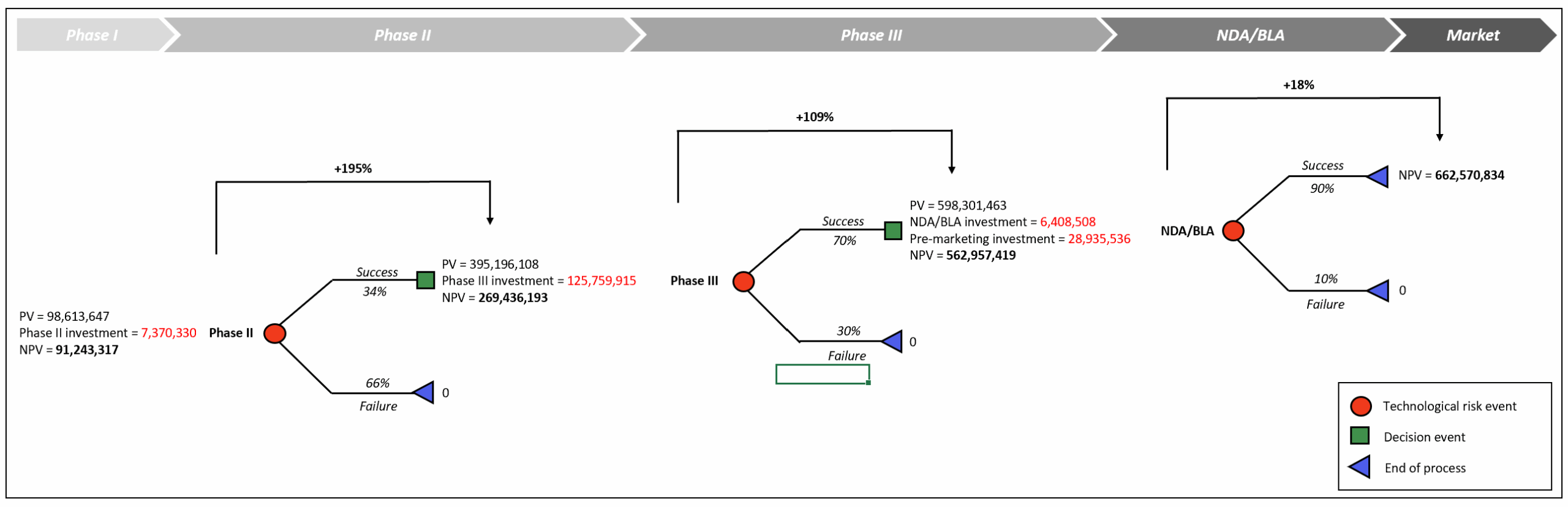

Given the high risk and uncertainty of biotech R&D, managerial flexibility is a crucial component of value. We use Decision Tree Analysis (DTA) to map out the strategic choices available throughout the development process. This approach helps us capture technological and diversifiable risks not priced by the market and reflects the real options managers have—such as whether to continue or halt a project at key milestones.