The Art of Saying No: Why Great Investors Reject More Than They Accept!!

Recently, I stumbled upon an article where a business angel shared how he had done well, but also missed some very interesting investments that could have delivered excellent returns. He recommended strategies to improve the accuracy of his good investments.

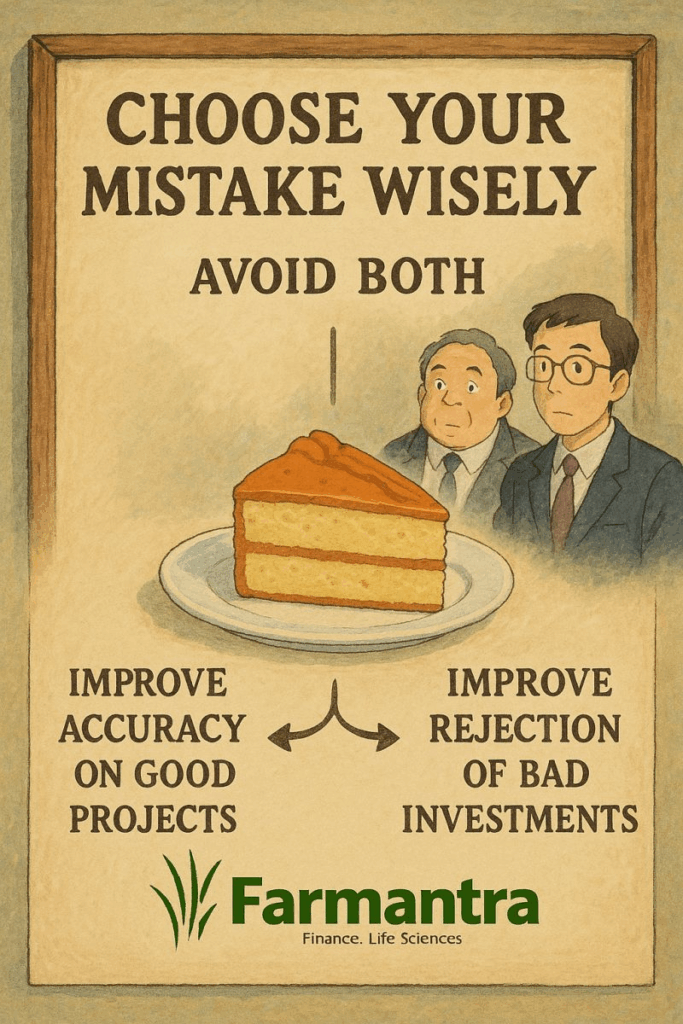

However, he missed one big truth: You can’t have your cake and eat it too.

Let me explain.

Two Key Errors Every Investor Makes

- Making a bad investment, thinking it’s a great one (like doing self-harm)

- Rejecting a good investment, thinking it’s a bad one

Here’s the catch: these two types of errors are inversely related.

If you try to minimize one, the other usually increases — and vice versa.

So the real question is: Which risk should we minimize to maximize returns?

A Simple Calculation

Assume there are 5,000 total investment opportunities:

- 1,000 are good

- 4,000 are bad

You have 80% accuracy for both recognizing good investments and rejecting bad ones.

Scenario A: Baseline Accuracy (80% correct in both)

- Correctly invest in 80% of 1,000 good investments → 800

- Incorrectly invest in 20% of 4,000 bad investments → 800

- Total investments = 1,600

- Success rate = 800 / 1,600 = 50%

Scenario B: Improve accuracy on good investments (90%)

- Correctly invest in 90% of 1,000 good investments → 900

- Still invest in 20% of 4,000 bad → 800

- Total investments = 1,700

- Success rate ≈ 52.9%

A small improvement from 50% to 52.9%.

Scenario C: Improve rejection of bad investments (accept only 10%)

- Still invest in 80% of 1,000 good → 800

- Now invest in 10% of 4,000 bad → 400

- Total investments = 1,200

- Success rate ≈ 66.7%

A big jump from 50% to 66.7%!

Conclusion

Minimizing the second error—rejecting bad investments—leads to a much higher success rate than maximizing your ability to spot good ones.

To be a successful investor, we must master the art of saying no.

It’s okay to miss the next Facebook — because you can’t minimize both errors at once.

Leave a Comments