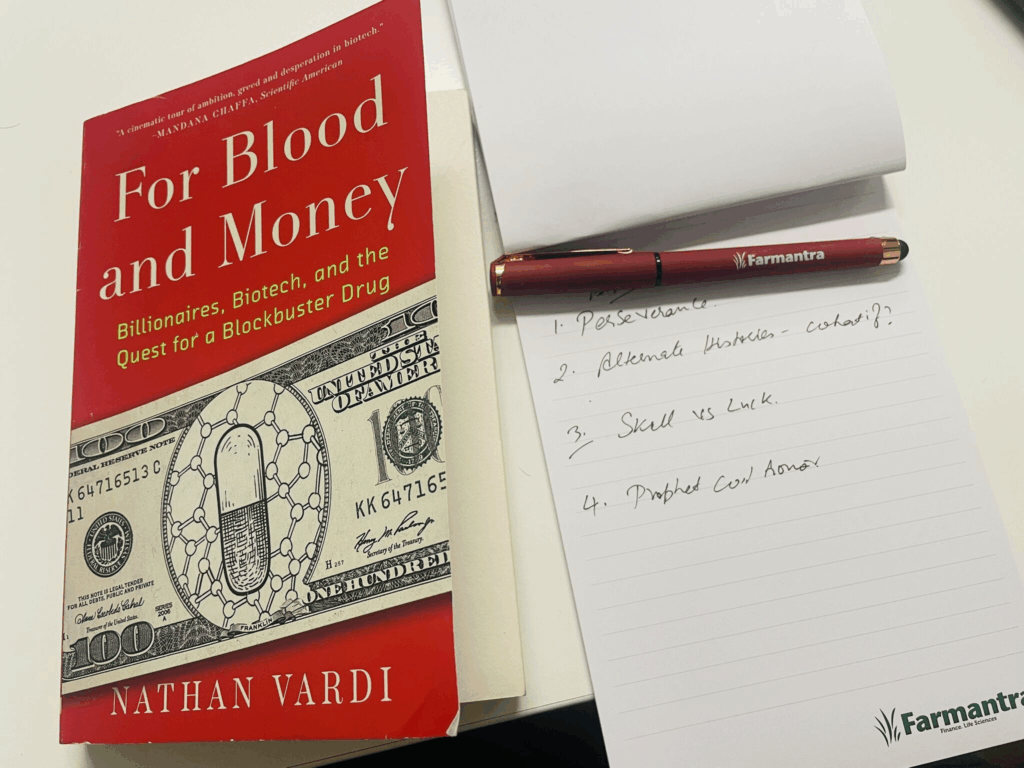

Not a Book Review – 4

Have you witnessed the “prophet without honor” effect in your company?

It’s widely observed that advice from experienced internal team members is often dismissed or undervalued, while similar advice from prestigious external consultants or top firms—suddenly feels credible, urgent, or “strategic.”

I felt both empathy and disappointment for Ahmed Hamdy, the CMO who was fired from Pharmacyclics after disagreeing with the newly inducted Genentech team (brought in by the CEO) regarding the company’s strategy to conduct trials on Mantle Cell Lymphoma (MCL), which could have secured a breakthrough designation.

Ahmed believed in a start-up mentality—trial and error—but was dismissed because his ideas didn’t align with the Genentech gang’s approach.

Lesson 1

This made me wonder: What if Pharmacyclics had followed Ahmed’s plan and pursued Phase 2 trials for MCL?

Nobody knows. But since the company was later sold for $21B, one could argue that not expanding into MCL was the right decision—though that’s hindsight bias.

This raises an important point about alternative histories—what would have been the outcome if Ahmed’s strategy had been pursued? Taleb argues that we should judge decisions by the cost of the alternative—how things might have played out differently.

Interestingly, Ahmed did not support a similar strategy in his next venture, Acerta Pharma (which he co-founded). When investors pushed for the MCL path, he resisted. Acerta was eventually sold for $7B ($4B upfront, the rest contingent on regulatory success and sales).

Lesson 2

This brings me to a fascinating insight: Persistence.

Breakthrough drugs often come from long-term, high-risk research that many dismiss as too speculative. Pharmacyclics’ early bet on BTK inhibitors was initially seen as a gamble, but persistence led to Imbruvica, a blockbuster drug.

Take Wayne Rothbaum, a private investor who backed Pharmacyclics. He sold his shares early (missing out on ~$700M) when he feared results wouldn’t meet expectations. Yet, he still pocketed ~$3B from Acerta’s sale to AstraZeneca.

In investing, one of the biggest risks is often selling too soon—a mistake Rothbaum made, but impressively recovered from.

Lesson 3

Another key figure is Bob Duggan.

He was a successful entrepreneur but had no biotech experience. Was he an unconventional choice for CEO? And was his success at Pharmacyclics just luck?

I’d argue skill, not luck.

If he had failed in all other ventures and only succeeded in his first biotech stint, we could call it luck. But Duggan had already made fortunes in the cookie and ethernet businesses in the 1990s.

In 100 alternate universes, if someone succeeds 90+ times, that’s skill.

Final thought

There are many other lessons from this book—perhaps it’s your turn to share them in the comments?📖

Leave a Comments