Relative Valuation – When Comparables Fall Short: Building Value Through Patterns and Drivers

When direct product data is limited, we rely on relative valuation to estimate potential deal value. This often involves analysing precedent transactions to understand what similar assets have commanded in the market.

Rather than requiring an exact match, we identify deals with a comparable risk-return profile – focusing on alignment in therapeutic area, development stage, regulatory complexity, market size, and strategic relevance.

In Biotech industry in high-risk areas or untapped markets it is very difficult to find clear predecents to compare with. In this situation, we move beyond direct analogues and look for structural patterns in deal-making.

This includes:

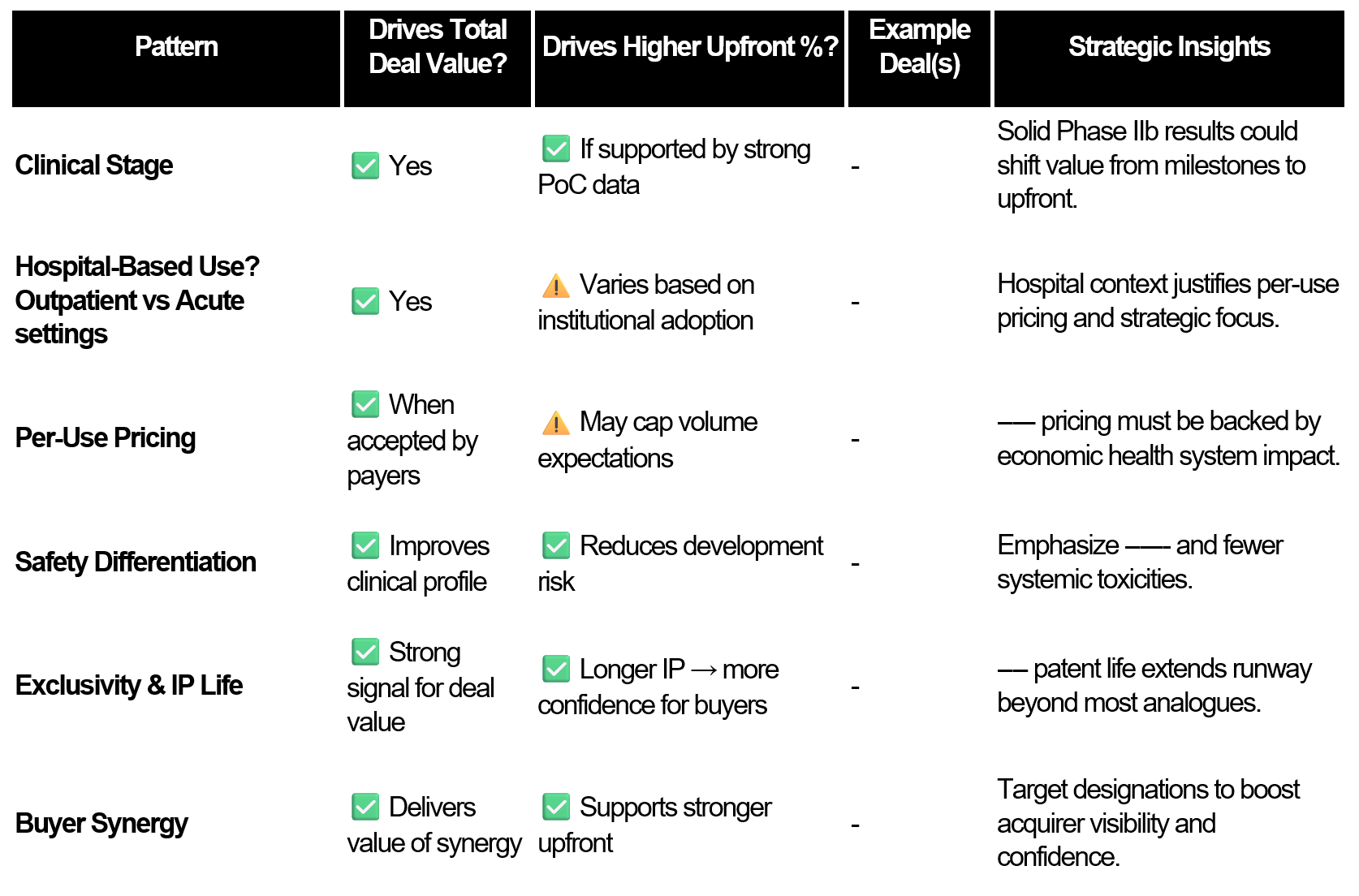

- Applying heuristics to identify patterns in deal data.

- Mapping value drivers.

- Identifying valuation anchors and outlier deals.

By understanding how complexity shapes value, and how certain characteristics consistently drive premium outcomes we can overcome the fact that no precedent transactions exist. We argue more on how to solve complex problems in this post.